7667766266

enquiry@shankarias.in

Prelims: Indian Economy | Current events of national and international importance

Why in News

Recently, the Reserve Bank of India’s (RBI’s) central board has sought the government’s approval to expand the range of the contingent risk buffer (CRB).

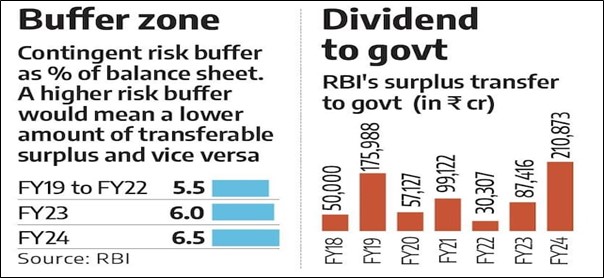

The Economic Capital Framework adopted in 2019, based on the Bimal Jalan Committee's recommendations, stipulates that a specific portion of the Reserve Bank of India's (RBI) surplus earnings is allocated to a Contingency Risk Buffer (CRB), while the remaining surplus is transferred to the Government of India.

|

Status of CRB in Recent Years |

|

RBI’s Central Board

Reference

Related News – RBI’s Surplus Transfer to Government