7667766266

enquiry@shankarias.in

Prelims: Economic and Social Development | Current events of national and international importance.

Why in News?

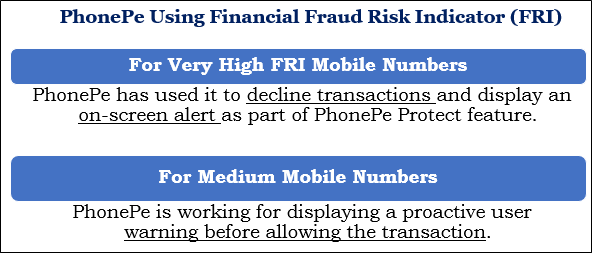

Recently, the Department of Telecommunications (DoT) has announced sharing of “Financial Fraud Risk Indicator (FRI)” with related stakeholders.

Reference