Why in news?

A recent report by World Bank say that India needs approximately 70 lakh crore rupees by 2036 to meet its urban infrastructure needs.

Urbanization is the process of people moving from rural to urban areas, and the corresponding growth in the number of people living in cities.

|

Revenue Head |

Sources of Revenue |

|

Tax Revenue |

Property tax, advertisement tax, tax on animals, vacant land tax, entertainment tax, surcharge on stamp duty, profession tax, Motor vehicles tax. |

|

Non-tax Revenue |

User charges, municipal fee, sale & hire charges, lease amount. |

|

Assigned/shared revenue |

ULBs receive a percentage of taxes levied and collected by the state government. |

|

Grants-in-aid |

Grants from central government and state government under various projects and schemes. |

|

Loans |

Loans borrowed by the local authorities for capital works from HUDCO, LIC, State and Central Governments, Banks and Municipal Bonds. |

Due to rapid urbanization, urban local bodies will be home to 40% of the population by 2036, and urban areas contribute almost 70 % to GDP.

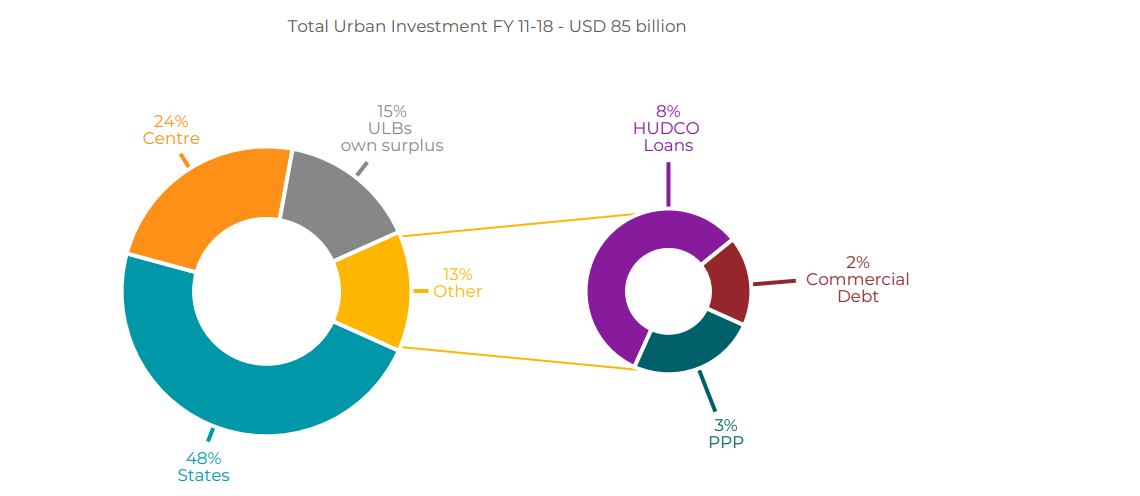

The Hindu |India’s urban infrastructure financing