7667766266

enquiry@shankarias.in

Mains Syllabus: GS III- Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment.

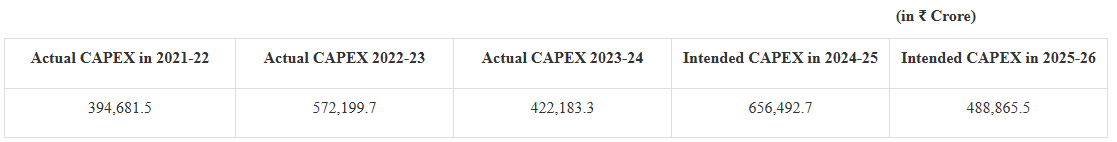

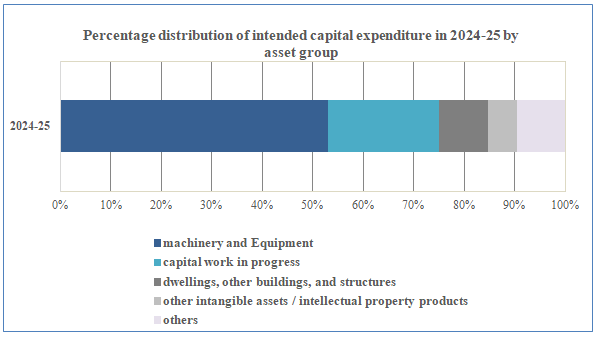

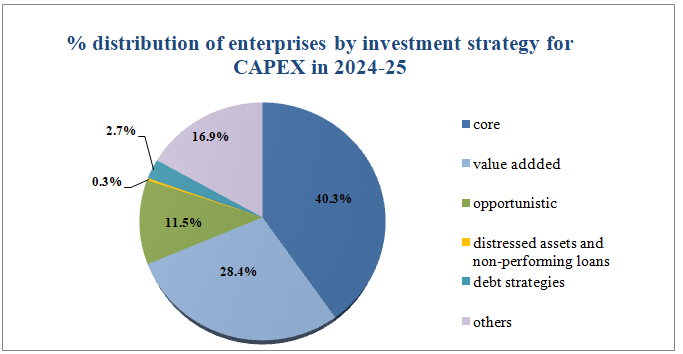

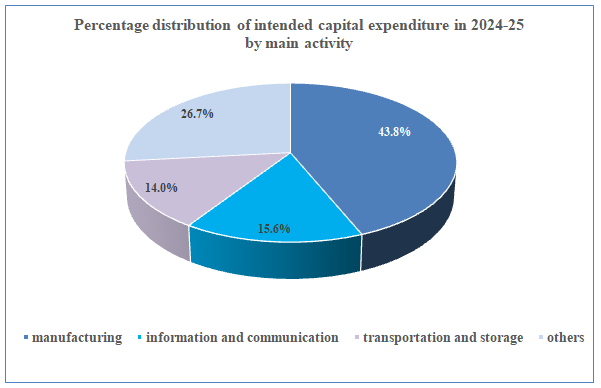

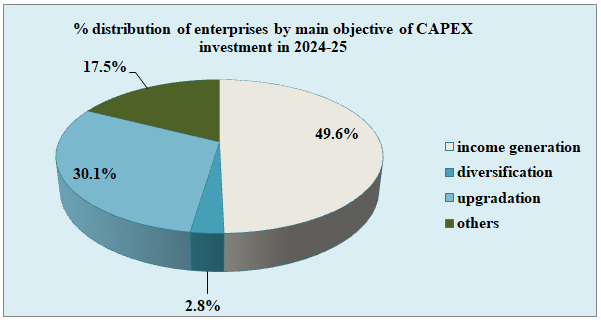

The Ministry of Statistics and Programme Implementation (MoSPI) has released the first ever “Forward-Looking Survey on Private Sector CAPEX Investment Intentions”.

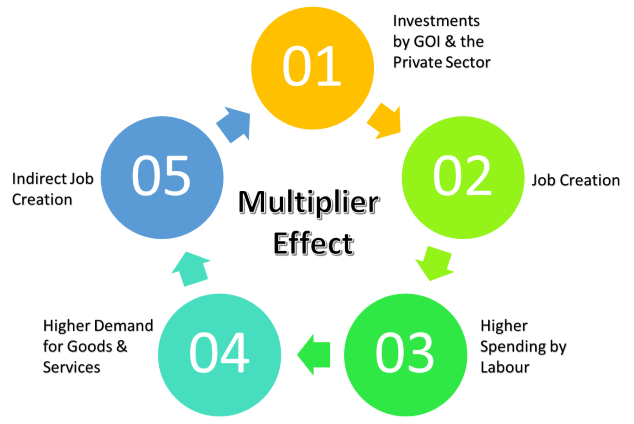

What are the significances of capital expenditure?

PIB | Forward-Looking Survey on Private Sector CAPEX Investment Intentions