7667766266

enquiry@shankarias.in

Mains Syllabus – GS III - Indian Economy and issues relating to planning, mobilization, of resources, growth, development and employment

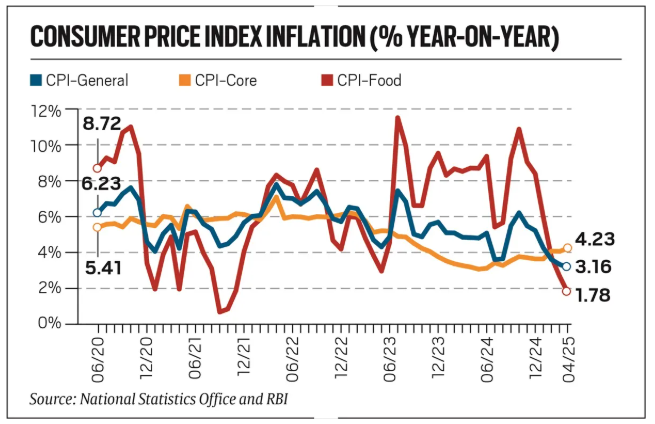

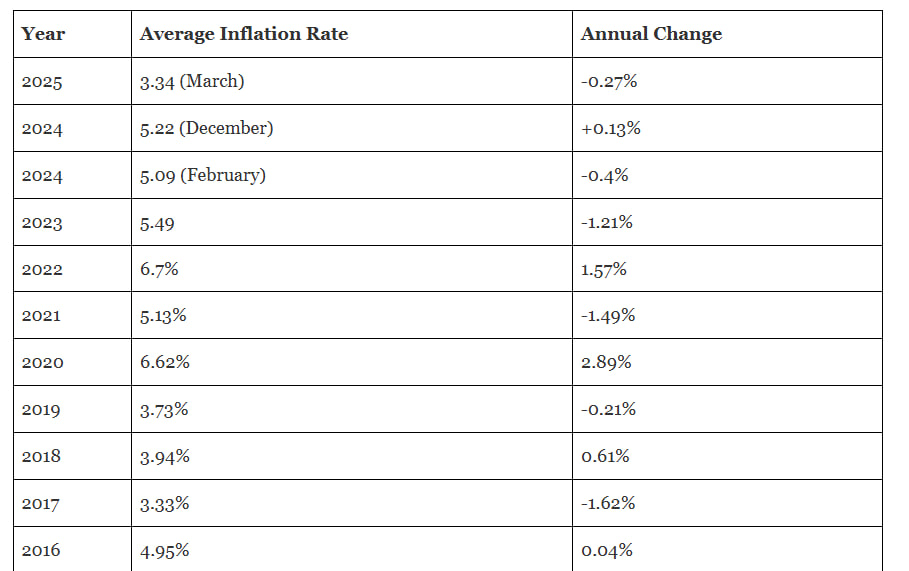

For the past 2 months India’s inflation indices were making turn around from the past 2-year trend.

|

Components of CPI |

|

|

|

|

|

|

|

Consumer Food Prices Inflation (CFPI) - Out of 12 sub-groups contained in ‘Food and Beverages’ group, CFPI is based on ten sub-groups, excluding ‘Non-alcoholic beverages’ and ‘Prepared meals, snacks, sweets etc.’. |

|