7667766266

enquiry@shankarias.in

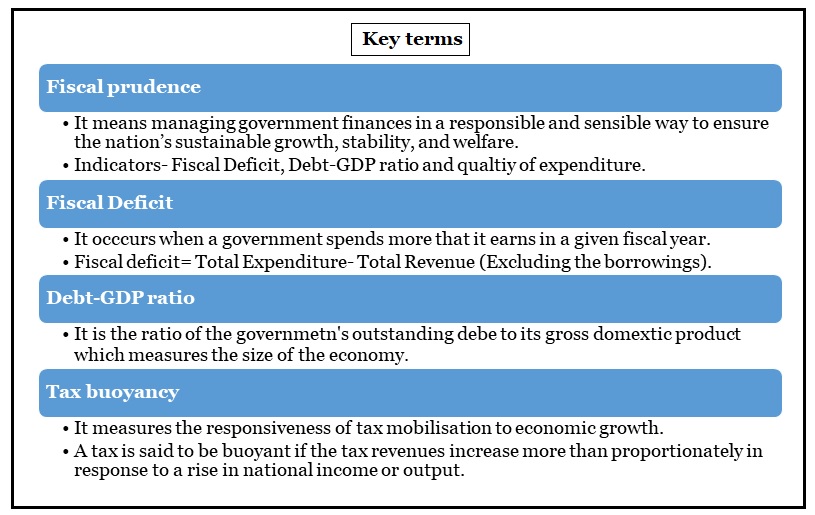

A close look at the government’s accounts highlights that fiscal deficit is owing to low revenues and not high spending.

India achieved fiscal prudence by enacting the Fiscal Responsibility and Budget Management (FRBM) Act in 2003, which set targets for reducing its fiscal deficit and debt-GDP ratio.

|

FRBM Act, 2003 |

|

India’s subsidies as a % of GDP were 1.4% in 2020, which was higher than the global average of 0.9%

Reference