Mains: GS II – Effect of Policies and Politics of Developed and Developing Countries on India’s interests.

GS III – Effects of Liberalization on the Economy

Recently, The Indian rupee has been in the news recently for its sharp depreciation against the dollar.

Brent crude is a specific type of light, sweet crude oil, and it's also a major global benchmark for oil prices.

It's primarily sourced from the North Sea oilfields and is widely traded because it's easy to refine into gasoline and diesel.

Foreign portfolio investors are those who are holding financial assets, such as stocks and bonds, in another country to diversify their portfolios.

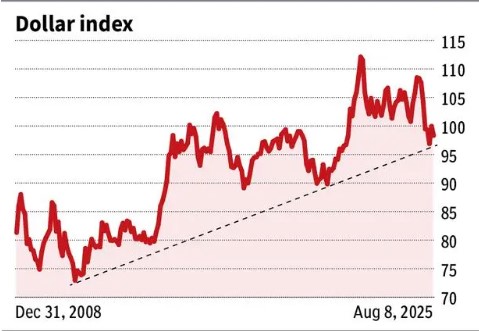

U.S. Dollar Index (USDX), is a tool for assessing the strength or weakness of the US dollar in relation to a basket of major currencies.