Why in news?

It was recently announced that the U.S. would not renew exemptions for India from its sanctions for importing oil from Iran.

What was the exemption on?

- The US sanctions on Iran was in relation to the US withdrawing from the nuclear deal with Iran, the Joint Comprehensive Plan of Action (JCPOA). Click here to know more.

- The sanctions restrict sales of oil and petrochemical products from Iran, and led entities to end their deal with Iran’s energy sector.

- But US had granted waivers, known as Significant Reduction Exceptions (SRE), last November for 6 months until May 2, 2019.

- It was offered to 8 countries - India, China, Japan, South Korea, Taiwan, Turkey, Italy and Greece.

- Nevertheless, the US insisted that these countries reduce oil imports from Iran to zero eventually, allowing only limited imports.

How crucial is oil import to India?

- India is currently the world’s third-biggest oil consumer.

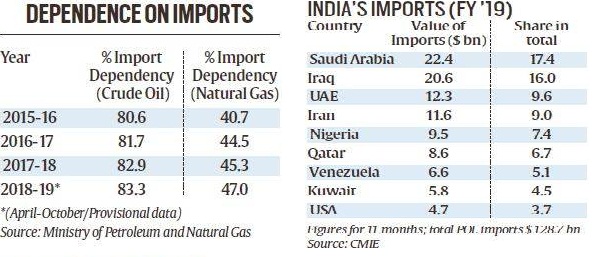

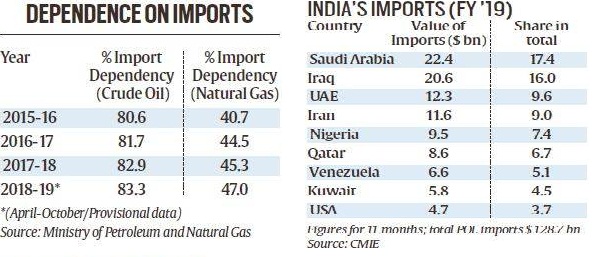

- It meets more than 80% of its crude oil requirements and around 40% of its natural gas needs through imports.

- Moreover, domestic oil and natural gas production has been declining for the last few years.

- But the energy needs of the economy have grown.

How dependent is India on Iranian oil?

- India is Iran’s top oil buyer after China.

- Iran was the fourth largest supplier of oil to India in 2018-19 when India imported 23.5 million tonnes from Iran.

- Of India’s total $128.7 billion import of Petroleum, Oil and Lubricants (POL), Iran accounted for close to 9%.

What are the implications of the US's move?

- The U.S. has made it clear that Indian companies that continue to import oil from Iran would face severe secondary sanctions.

- These include being taken out of the SWIFT international banking system and a freeze on dollar transactions and U.S. assets.

The possible implications for India include the following:

- any spike in global crude oil prices will widen the trade deficit and current account deficit, especially in the absence of the Iranian balancing factor

- rupee could be impacted if the trade and current account deficits were to widen

- an increase in the import bill will tend to put more pressure on the rupee

- on the revenue side, higher oil prices mean more revenue for the states as tax is ad valorem

- for the Centre, though, higher oil prices may not materially impact the fiscal math as the duty rates are fixed

- the expenditure impact would primarily be on account of fuel subsidy outlays

- there could be impact on inflation depending on crude price movement and government's decision on passing it on to the consumer

How prepared is India?

- The US move comes at a time when the price of the Indian crude basket has been rising.

- But India has said the country is “sufficiently prepared” to deal with the impact of the ending of the waiver.

- In the past several months, India has worked hard to significantly diversify its energy sources in preparation for this situation.

- Indian refiners have almost halved their Iranian oil purchases since November, when the sanctions came into effect.

- Indian refiners are increasing their planned purchases from the Organisation of the Petroleum Exporting Countries (OPEC).

- Purchases from Mexico and even the US are also being planned to make up for the loss of Iranian oil.

- E.g. India imported crude from the US for the first time two years ago; first US crude consignment reached Paradip in October, 2017

- Since October 2017, four PSUs have placed orders for 11.85 million barrels.

- Indian companies have also contracted 8mn metric tonnes per annum of liquified natural gas (LNG) and ethane condensate from the US.

What are the challenges ahead?

- There are other substitute crude suppliers for India including Saudi Arabia, Kuwait, Iraq, Nigeria and the US.

- But the concern is that they do not offer the attractive options that Iran does, including 60-day credit, and free insurance and shipping.

- So the challenge now is to secure an alternative supplier at competitive terms in an already tightening global situation.

- The projected drop in Iranian exports could further squeeze supply in a tight market.

- This is added by the fact that the US has also sanctioned Venezuela.

- Also, the OPEC and allied producers including Russia have voluntarily cut output.

- All these have pushed up oil prices more than 35% this year.

- Iran - India and China could show a degree of defiance while cutting back on their exposure to Iranian crude.

- But India’s ties with Iran are significant and historic, and New Delhi will work hard to maintain some links.

- So estimatedly, India may maintain around 100,000 bpd (barrels per day) of Iranian imports paid for using a rupee payment system.

What is Iran's response?

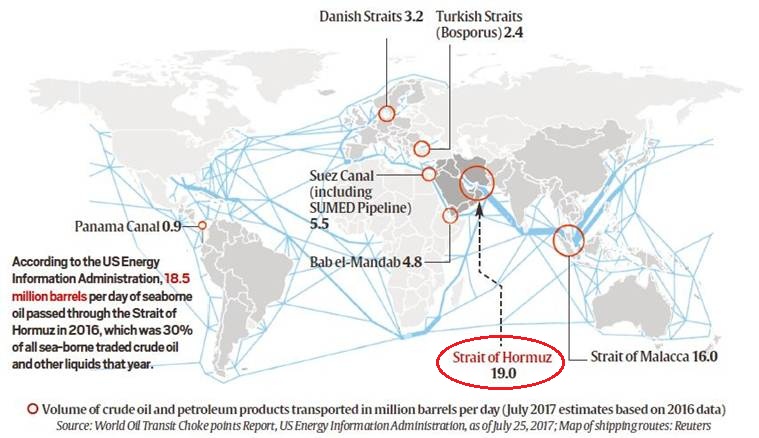

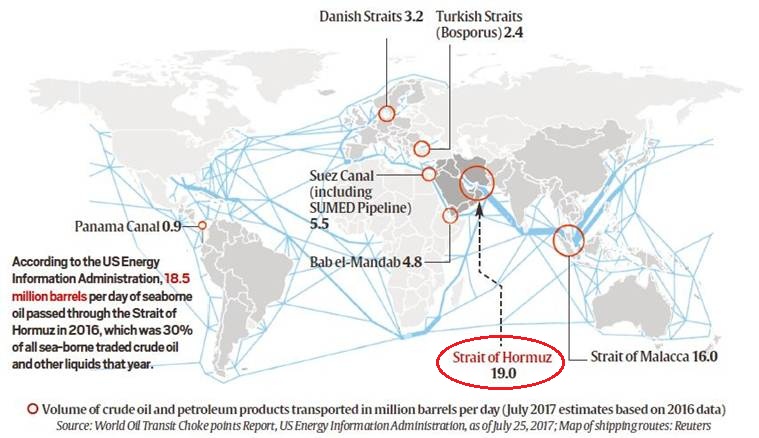

- Soon after the US announcement, Iran threatened to close the Strait of Hormuz.

- It is a neck of water between Iran's southern coast and the northern tip of the sultanate of Oman.

- The Strait of Hormuz is the lane through which a third of the world’s seaborne oil passes every day.

[The seven choke points in the map above are critical nodes of the world’s energy security grid.]

- However, Iran cannot legally close the waterway unilaterally because part of it is in Oman’s territorial waters.

- But ships pass through Iranian waters, which Iran’s Islamic Revolutionary Guards Navy controls.

- Massive stakes give Iran leverage here, but closing the Hormuz Strait may lead to serious consequences.

- Notably, the US too has said that closing the Hormuz Strait would amount to crossing a “red line”.

- This is one reason why Iran has not acted on its threats to close the Strait in 40 years of its hostility with the West.

Source: Indian Express, The Hindu