7667766266

enquiry@shankarias.in

Mains: GS III – Effects of Liberalization on the Economy, Changes in Industrial Policy and their Effects on Industrial Growth

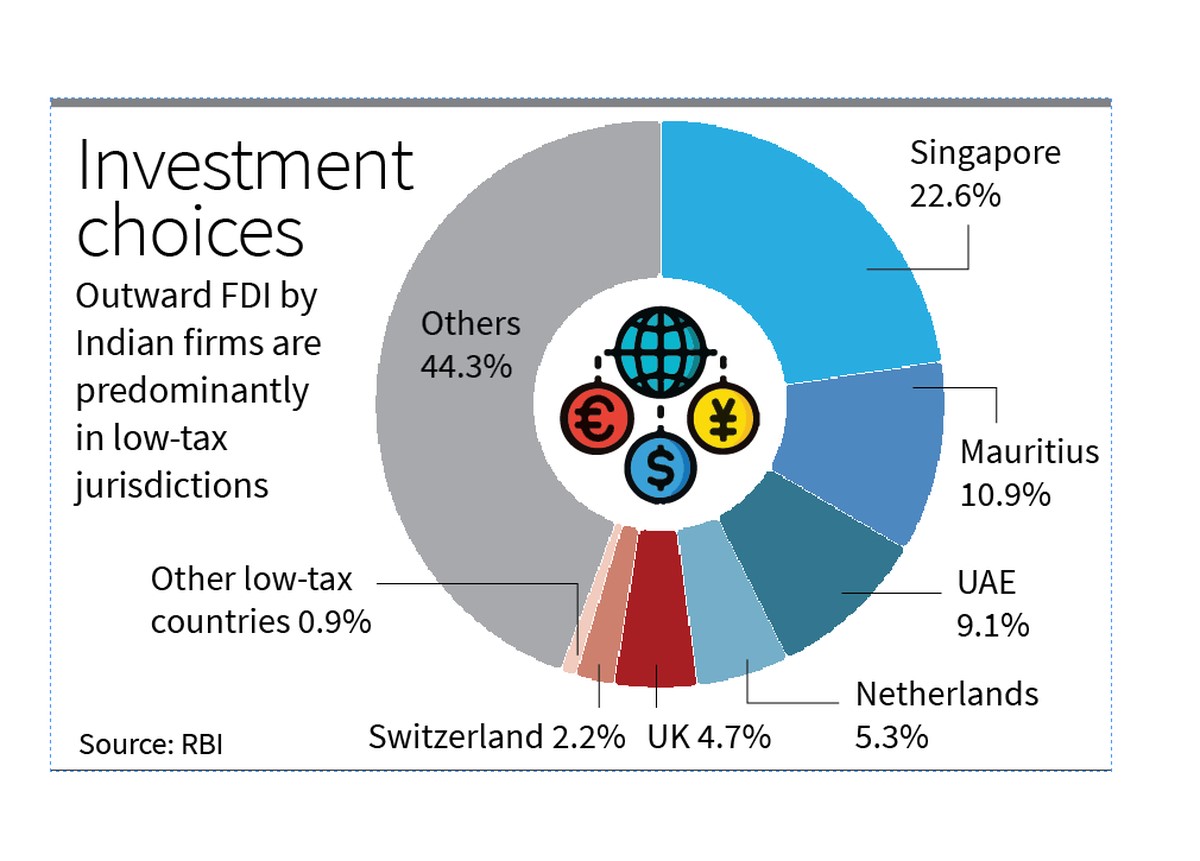

Recently, An analysis of RBI data by The Hindu shows that nearly 56% of such investments in 2024-25 were in low tax jurisdictions such as Singapore, Mauritius, UAE, the Netherlands, U.K. and Switzerland.

A tax haven refers to a country or jurisdiction that offers foreign individuals and businesses little to no tax liability in a politically and economically stable environment.

The Hindu| Outward FDI of India