7667766266

enquiry@shankarias.in

Prelims: Current events of national and international importance | Economy

Why in news?

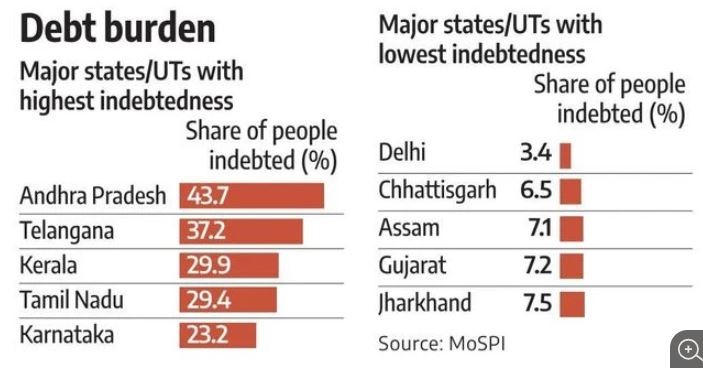

Recently, study published by Ministry of Statistics and Programme Implementation (MoSPI), namely “People in South India are comparatively more indebted than those in the rest of the country”.

MIS is a comprehensive household survey designed to collect data on a wide range of key indicators related to well-being.

Key Observation

Reference

Business Standard | Southern states lead in household debt charts