7667766266

enquiry@shankarias.in

Mains: GS II – Effect of Policies and Politics of Developed and Developing Countries on India’s interests

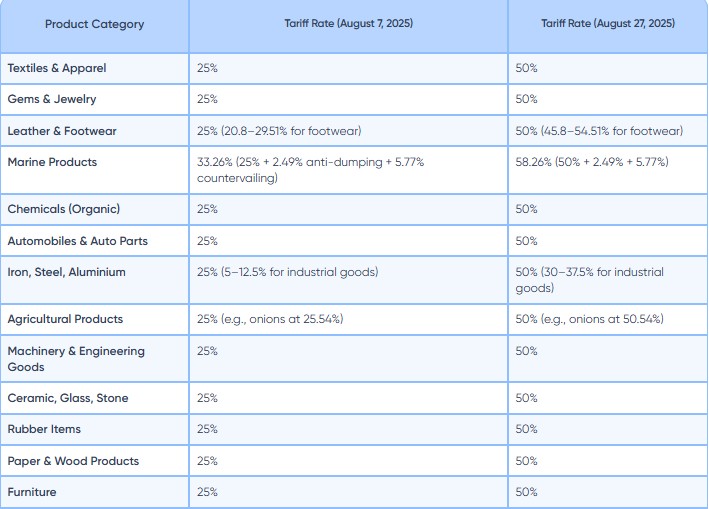

Recently, US president has announced a 25% additional penalty on Indian goods, for continuing to purchase oil from Russia, taking the total baseline tariff to 50%.

|

Sector |

Total Share in Exports in 2025 |

|

Textiles and apparels |

37% |

|

Chemicals |

15% |

|

Electrical machinery |

32% |

|

Jewellery |

30% |

|

Average Share in Exports for the last 3 Years

|