7667766266

enquiry@shankarias.in

Mains: GS III – Science and Technology- Effects of Liberalization on the Economy

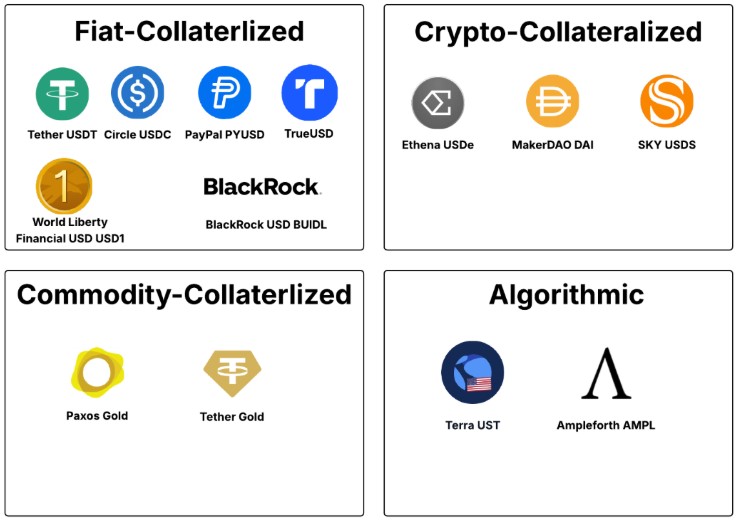

Recently, Bank of England places limits on the transaction of stablecoin transactions.

The Indian Express| Stablecoins