Click here for Part I.

What is the issue?

- FRDI bill is expected to be tabled in winter session of the parliament.

- But it has raised concerns among depositors on how they would be repaid in case of liquidation of banks.

What is the existing method?

- The Deposit Insurance and Credit Guarantee Corporation (DICGC) is an RBI subsidiary, established in 1971.

- In case a stressed bank had to be liquidated, the depositors would be paid through DICGC.

- It insures all kinds of bank deposits up to a limit of Rs.1 lakh.

- It is mandatory for banks to pay a sum to the DICGC as insurance premium.

What are the concerns in the proposed bill?

- The proposed Bill seeks closure of the DICGC, as the credit guarantee will be taken care of by the Resolution Corporation.

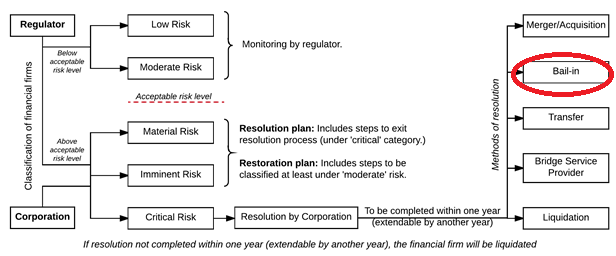

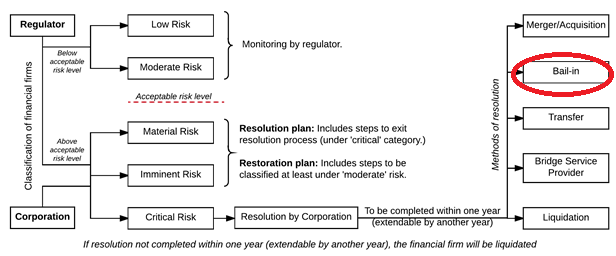

- The Resolution Corporation is empowered to monitor financial firms, calculate stress and take corrective actions in case of a failure.

- According to Section 52 of the proposed Bill, depositors will lose their rightful claim to retrieve their savings in case of liquidation of banks and insurance companies.

- It does not specify the fixed insured amount to be paid by the bank to the resolution corporation.

- It does not even specify the amount a depositor would be paid in case of liquidation.

- It is given that corporation may decide on the compensation in case of any bank failure, which could well be less than Rs. 1 lakh.

- Bail In - It also proposes 'bail-in' as one of the methods to resolution, where the banks issue securities in lieu of the money deposited.

- In the past, the bail-in efforts had largely worked against depositors.

- The ambiguities on how the depositors would be repaid needs to be addressed.

- Thus, there is a need to enhance insurance cover on deposits which should ideally continue to be managed by the RBI.

Source: BusinessLine