Why in news?

FRDI Bill was introduced in Parliament during Monsoon Session 2017.

What are financial firms?

- Financial firms include banks, insurance companies, and stock exchanges, among others.

- Since they transact with each other, their failure may have an adverse impact on financial stability and result in consumers losing their deposits and investments.

- e.g In 2008, the failure of a Lehman Brothers impacted the financial system across the world.

- Currently, there is no specialised law to resolve financial firms.

- Provisions to resolve are found scattered across different laws.

What are the highlights of the bill?

- The Bill seeks to create a consolidated framework for the resolution of financial firms.

- It repeals the Deposit Insurance and Credit Guarantee Corporation Act, 1962 and amends 12 other laws.

- Resolution Corporation - The central government will establish a Resolution Corporation.

- The Corporation will have a Chairperson and its members will include representatives from the Finance Ministry, RBI, and SEBI, among others.

- The Corporation will-

- Provide deposit insurance to banks

- Classify service providers based on their risk, and

- Undertake resolution of service providers in case of failure.

- It may also investigate the activities of service providers, or undertake search and seizure operations if provisions of the Bill are being contravened.

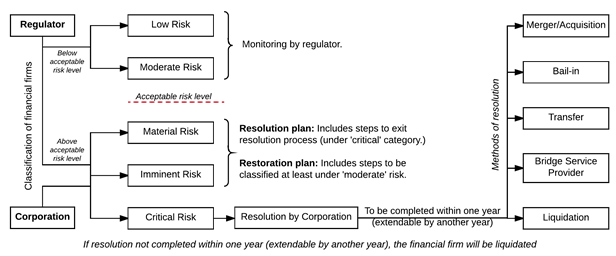

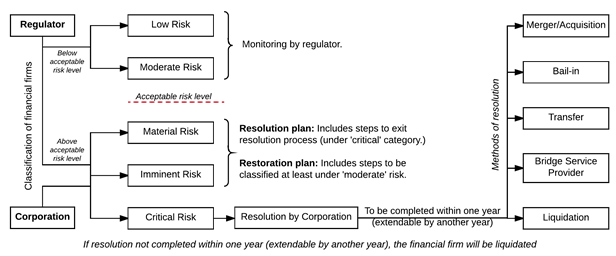

- Risk based classification - The Corporation, in consultation with the respective regulators specify criteria for classifying service providers based on their risk of failure.

- A service provider categorised under the ‘imminent’ or ‘critical’ category will submit a restoration plan to the regulator, and a resolution plan to the Corporation. These plans will contain information, including: (i) details of assets and liabilities, (ii) steps to improve risk based categorisation, and (ii) information necessary for resolution of the service provider.

- Administration - The Corporation will take over the management of the service provider from the date when it is classified as ‘critical’.

- Resolution - The resolution of a service provider classified under the ‘critical’ category can be done by using

- Transfer of its assets and liabilities to another person,

- Merger or acquisition, and

- Creating a bridge financial,

- Bail-in and

- Liquidation

- Time limit - The service provider will automatically be liquidated if its resolution is not completed within the maximum time period of two years.

- Liquidation and distribution of assets - The Corporation will require the approval of the National Company Law Tribunal to liquidate the assets of a service provider.

- Offences - The Bill specifies penalties for offences such as concealment of property, and destruction or falsification of evidence.

Does the Bill guarantee the repayment of bank deposits?

- Currently, the Deposit Insurance and Credit Guarantee Corporation (DICGC) provides deposit insurance for bank deposits up to 1 lakh rupees per depositor.

- The Bill proposes to subsume the functions of the DICGC under the Resolution Corporation.

- It will guarantee the repayment of a certain amount to each depositor in case the bank fails.