Why in news?

The RBI recently made its submissions to the Standing committee on Finance to brief on the state of the economy.

What are the submissions made?

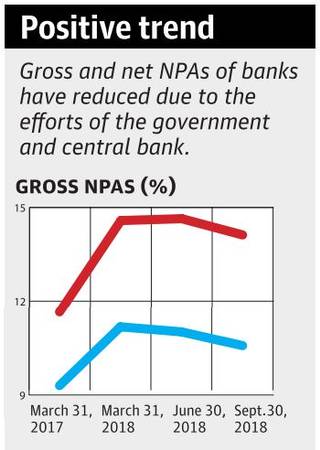

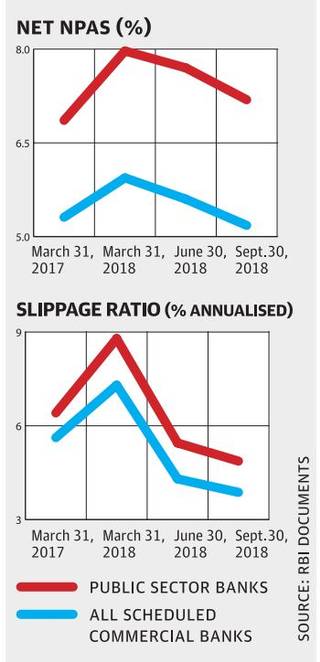

- On NPA - Both gross and net non-performing assets (NPAs) of scheduled commercial banks have reduced recently since their peak in March 2018.

- Also, the proportion of NPAs from Public sector banks has marginally come down from 86.6% to 85.9%. [Image]

- However, the profitability of banks was still impacted due to a decline in earnings from loan assets and on higher provisioning required due to deterioration in asset quality.

- The slippage ratio (i.e. the percentage of fresh NPAs as percentage of standard advances) is also declining which reflects improving credit discipline in the banks.

- On fiscal health - The risks that could pose a challenge to the government’s commitment to meet the FRBM targets are –

- Oil prices

- Uncertainty over the effect of the MSP hike

- Revenue impact of the lower-than-expected GST collections

- Cut in excise duty on fuel

- Decline in the gross financial savings of households

- HRA revisions by the states

- Farm loan waivers by states

- Thus, the central government debt to GDP ratio target of 40% and the general government (including states) debt to GDP ratio target of 60% by 2024-25 should be focussed upon for achieving the revised FRBM targets.

- On demonetisation – It caused a shortfall in the government’s non-tax revenue which has impacted the surplus that RBI could transfer to the Centre.

- This is mainly because of the rapid pace of remonetisation and increased cash in circulation(CIC), which accounted for 101.8% of its pre-demonetisation levels in March 2018.

- However, there is a sharp increase on the volume of digital transactions, which grew from about 900 million transactions in October 2016 to about 1,750 million in June 2018.

- Also, the monetary transmission from the policy rate to the banks’ deposit and lending rates improved during 2017-18 due to the demonetisation-induced liquidity.

- On credit flow - Total credit flow from banks to the commercial sector grew at 15.6%, especially the adjusted non-food bank credit.

- Adjusted non-food bank credit includes non-food bank credit and total non-statutory liquidity ratio (SLR) investments of banks in commercial papers, shares and bonds/debentures.

- This will ease the credit flow and increase private investments in the country.

What is the stand of the RBI Governor?

- RBI’s autonomy is important to protect depositors’ interests

- Monetary policy has to be the exclusive domain of the RBI

- RBI’s reserves are central to maintain its AAA rating.

What should be done?

- Profitability of banks will continue to remain under stress as they provide for the bad loans in their books and/or take hair-cuts on recoveries through the insolvency process.

- Thus, banks need to monitor their small loans portfolio made under the Pradhan Mantri Mudra Yojana.

Source: The Hindu