What is the issue?

Petroleum prices are rising and there are considerable demands to the centre to reduce its excise duties on the product.

How the sector was deregulated?

- Being a basic intermediate good, it is operated through a special oil pool account funded by the surplus of ONGC and the refining companies, as well as direct government subsidies.

- Being an ideal commodity for indirect tax, high Central excise duty and high sales tax rates by the states at the retail level were levied.

- With the rising trend in international crude oil prices the subsidy burden of the oil pool account began to mount.

- There were demands that the oil market should be deregulated.

- But the excise revenues from oil was substantially larger than the subsidies provided by the centre.

- Also, the surpluses of petroleum mining and refining companies were substantial enough for cross subsidisation of the loss-making retail oil companies.

- But the entry of private players like Reliance and Essar into the retail trade made cross-subsidisation untenable.

- Thus the administered Price Mechanism for petroleum was dismantled and market pricing mechanism was allowed.

What was the consequence?

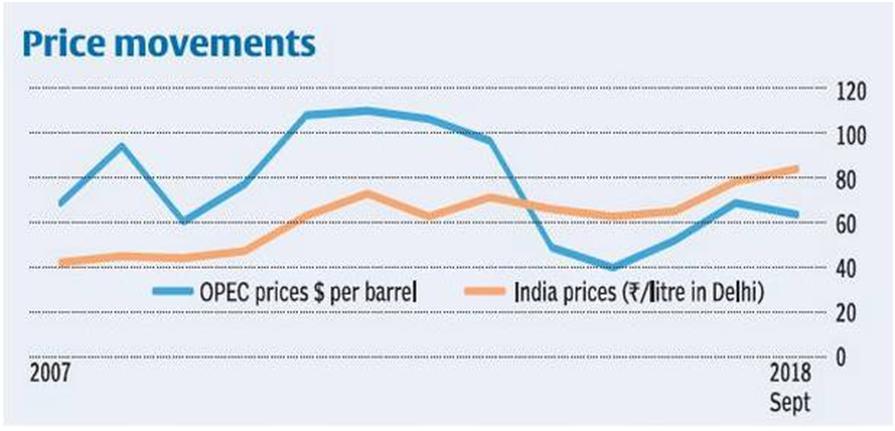

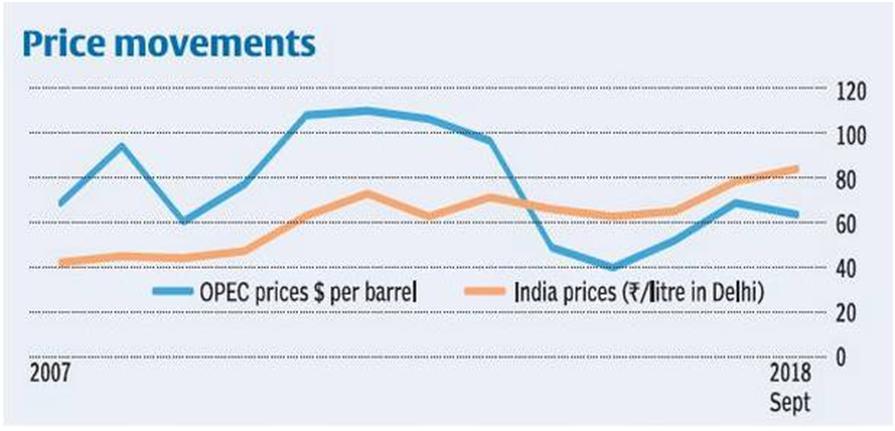

- The Centre chose to increase the excise duty on petrol and diesel, although OPEC prices showed a downward trend.

- The hike in excise duty was 380 per cent for diesel and 120 per cent for petrol between 2014 and 2017.

- The C&AG Report has observed that the huge increase in central excise collection from petroleum products (2015-16) was due to a sharp increase in per unit tax on petrol and diesel.

- The excise duty revenue of the central government from petroleum products which was Rs.88600 crores in 2013-14 peaked to Rs.2,53,254 crores in 2016-17.

- Never has indirect tax on any commodity witnessed such a sharp escalation as on petroleum products.

What is the present scenario?

- The international prices crude oil began to rise from late 2016.

- Yet the Centre refused to reduce the excise duties and prodded oil companies to raise their retail selling prices.

- The Centre fears an adverse impact on fiscal deficit, if any additional revenue from petroleum productsgets lost.

- The depreciating rupee also added to their woes.

- However, rising fuel prices are stoking an inflationary fire and imposing an unbearable burden on the people.

Should the states be held responsible?

- States are benefiting from petroleum price escalation through higher devolution after the 14th Finance Commission award in the share of central excise duty.

- However, only basic excise duty on petrol and diesel is shareable with the States and others are outside the divisible pool of taxes shareable with the States.

- Also, VAT rates has been hardly increasedin recent years and even some states have already reduced VAT rates to moderate the current price escalation.

What should the centre do?

- The centre argues that it keeps a substantial portion outside the shareable pool for its obligations on social sector spending.

- There is no established connection between higher duties on petroleum products and social sector spending.

- A demand has also been made that petroleum products be included in the GST.

- But before it gets into reality, a compensation package has to be finalised as per the GST compensation law.

- This would make the present compensation cess to be inadequate.

- Thus the solution is for the Centre to immediately roll back its excise duty spikes.

Source: Business Line