What is the issue?

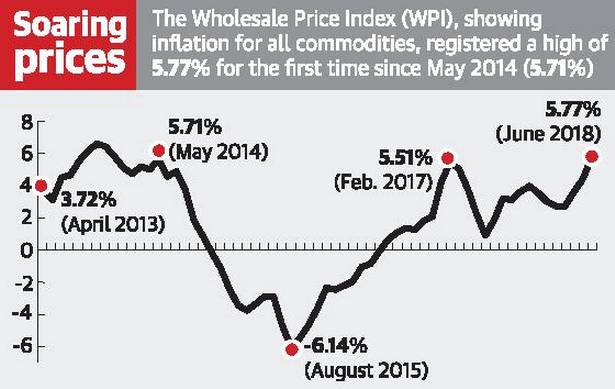

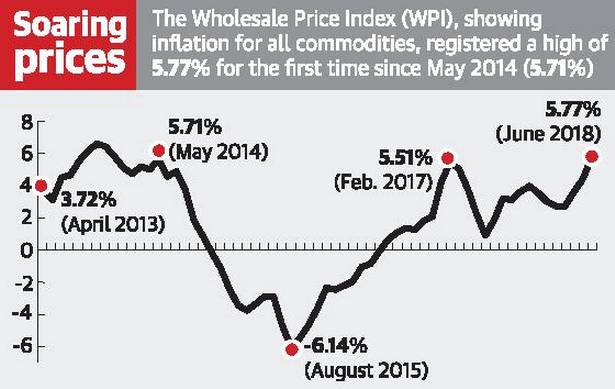

- The Wholesale Price Index (WPI) rose 5.77% on a year-on-year basis to a 54-month high in June 2018.

- The inflation scenario demands a closer look at the macro-economic conditions.

What are CPI and WPI?

- Both measure the inflationary trends i.e. movement of price signals within the broader economy.

- WPI tracks year-on-year wholesale inflation at the producer or factory gate level.

- It is a marker for price movements in the purchase of bulk inputs by traders.

- Consumer Price Index (CPI) tracks changes in prices levels at the shop end.

- It is thus reflective of the inflation experienced at the level of consumers.

- The two indices differ in the manner in which weightages are assigned.

- This applies to food, fuel and manufactured items as well as their sub-segments.

- E.g. weightage of food in CPI is far higher (46%) than in WPI (24%).

- Also, WPI does not capture changes in the prices of services but CPI does.

What are the driving factors for WPI rise?

- Rising crude oil prices has persistently driven inflation.

- Inflation in the fuel and power group has risen every month in the recent period.

- Food articles, especially vegetables, have been on a rising trend as well.

- The inflation in politically sensitive duo of potatoes and onions is a notable cause.

- Manufactured products (largest weight in the WPI) are also on an inflationary trend.

- WPI rise is also to be seen from the perspective of an unfavourable base effect.

- It is the effect of the previous year taken as the base for calculation.

- This is because the WPI inflation in June 2017 was just 0.9%.

Is WPI rise a concern?

- Policy - In 2014, RBI had adopted CPI as its key measure of inflation from the earlier WPI.

- India thus shifted to CPI as the benchmark for deciding policy rates (e.g. repo rate).

- Accordingly, RBI has a target to keep consumer-level inflation at 4% (+/- 2%).

- Any rise in CPI inflation beyond this comfort zone pressurises RBI to hike interest rates.

- So WPI rise might not appear relevant from a policy perspective.

- Economy - However, price changes at the producer level usually get transmitted to the consumers.

- But this could come with a time lag or may not be to the full extent of the impact at the producer level.

- So, the apprehensions with a higher WPI may not be valid at all times.

- Nevertheless, a steady rise in WPI is certainly an indicator of an overall inflationary pressure.

- It reflects the unbalanced conditions within the broader economy.

- Retail - There is a concern of a cascading effect of WPI increase on the CPI.

- This remains even after discounting for the base effect.

- Evidently, the retail inflation (CPI) had risen to a 5-month high of 5% in June, 2018.

How does it affect growth?

- Inflation-growth relationship is “significantly negative” if inflation is above a threshold value.

- It is “insignificant or significantly positive” if inflation is below the threshold value.

- Simply, inflation to a certain extent is favourable to the economy, above which it becomes harmful.

- But generally, the threshold values in developing countries are relatively higher.

- In India's case, roughly 4 to 5.5% inflation is said to be the range, above which it retards GDP growth rate.

- But substantial gains can be achieved if inflation is kept below the threshold.

How does the future look?

- Government has recently decided to increase the minimum support price for kharif crops.

- A possible inflationary pressure due to this exists already.

- On the other hand, inflationary trend has reinforced the expectations of a repo rate hike.

- As, rate hike would be a measure of controlling the inflationary trend.

- However, IMF in a recent update has said the Indian economy will grow slower than estimated earlier.

- It has also cut India’s growth projection for 2018-19 by 10 basis points to 7.3%.

- The pressure on growth due to the added impacts of inflation and faster interest rate hikes is the reason.

- Thus, balancing between inflation and growth prospects would be a challenging task for the policy makers in the near future.

Source: The Hindu, Indian Express