Click here for Part I and here for Part III

Why in news?

The Union Minister for Finance and Corporate Affairs, Ms. Nirmala Sitharaman tabled the Economic Su rvey 2018-19 in the Parliament.

What are the key highlights?

STATE OF THE ECONOMY IN 2018-19: A MACRO VIEW

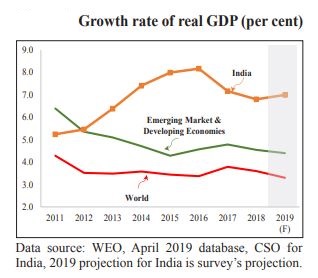

- Growth - Growth of GDP moderated to 6.8% in 2018-19 from 7.2% in 2017-18.

- However, India is still the fastest growing major economy.

- The slowdown in growth momentum is mainly on account of lower growth in -

- Agriculture & allied sectors

- Trade, hotel, transport, storage, communication and services related to broadcasting

- Public administration and defence sectors

- Growth in investment, which had slowed down for many years, has reached the lowest point. It has started to recover since 2017-18.

- Growth in fixed investment picked up from 8.3% in 2016-17 to 9.3% in 2017-18 and further to 10.0% in 2018-19.

- Inflation - India maintained its macroeconomic stability by containing inflation within 4% (3.4% in 2018-19).

- Deficit - India has maintained a manageable current account deficit at 2.1% of GDP.

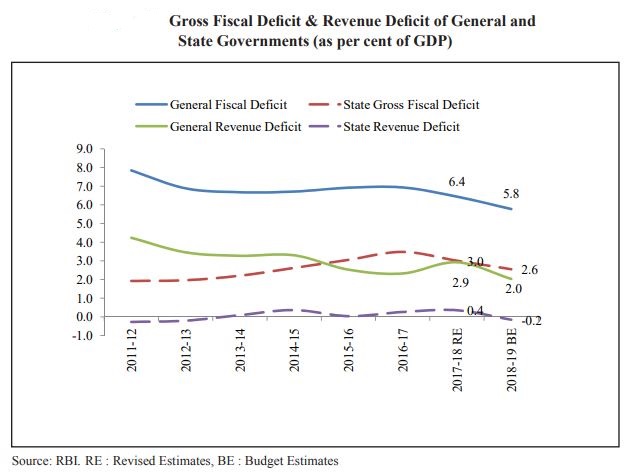

- Fiscal deficit of Central Government stood at 3.4% of GDP in 2018-19; it was 3.5% of GDP in 2017-18.

- Non-Performing Assets as percentage of Gross Advances reduced to 10.1% at end December 2018 from 11.5% at end March 2018.

- Outlook of Indian economy appears bright with prospects of pickup in growth in 2019-20.

- This comes in the backdrop of a pickup in private investment and robust consumption growth.

FISCAL DEVELOPMENTS

- Deficit - The revised fiscal glide path envisages achieving the targets of -

- fiscal deficit of 3% of GDP by FY 2020-21 [3.4% - end FY 2018-19]

- Central Government debt of 40% of GDP by 2024-25 [44.5% - end FY 2018-19]

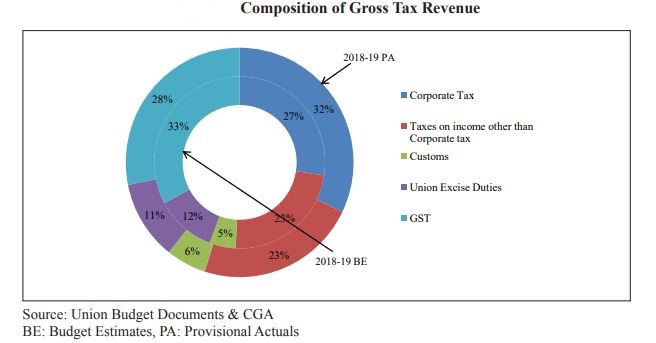

- Revenue - Budget 2018-19 envisaged a growth of 16.7% in gross tax revenue (GTR) over the revised estimates (RE) of 2017-18.

- GTR was estimated at Rs. 22.7 lakh crore for BE 2018-19, which was 12.1% of the GDP.

- Broadly, 51% of GTR was estimated to accrue from direct taxes and the remaining 49% from indirect taxes.

- Direct taxes have grown by 13.4% owing to improved performance of corporate tax.

- However, indirect taxes have fallen short of budget estimates by about 16%.

- There has been improvement in tax to GDP ratio over the last 6 years.

- However, GTR as a proportion of GDP has declined by 0.3 percentage points in 2018-19 PA (Provisional Actuals) over 2017-18.

- Non-tax revenue constitutes about 1.3% of GDP in 2018-19.

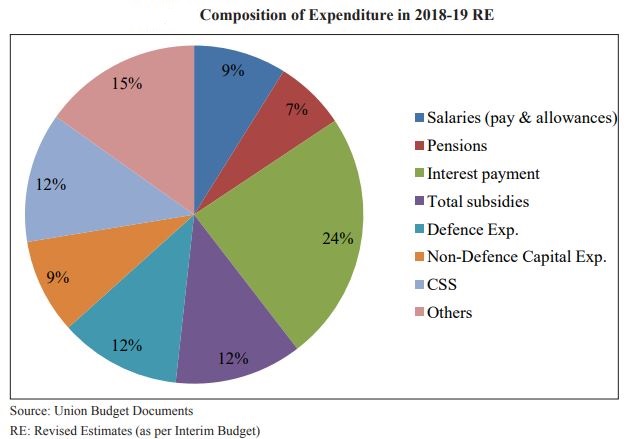

- Expenditure - As percent of GDP, total Central Government expenditure fell by 0.3 percentage points in 2018-19 PA over 2017-18.

- There was 0.4 percentage points reduction in revenue expenditure and 0.1 percentage point increase in capital expenditure.

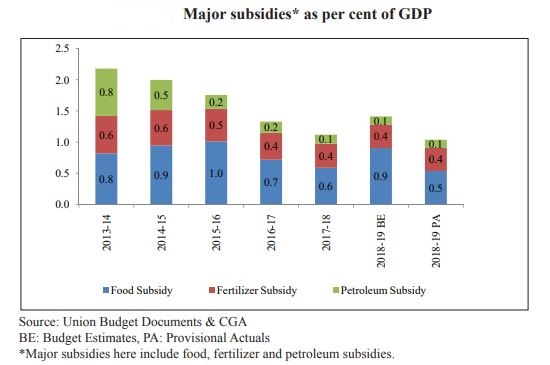

- Major subsidies comprising food, fertiliser and petroleum have continued their downward trend and have further declined.

- State Finances - With respect to States finances, their own tax and non-tax revenue show robust growth in 2017-18 Revised Estimates.

- This is envisaged to be maintained in 2018-19 BE.

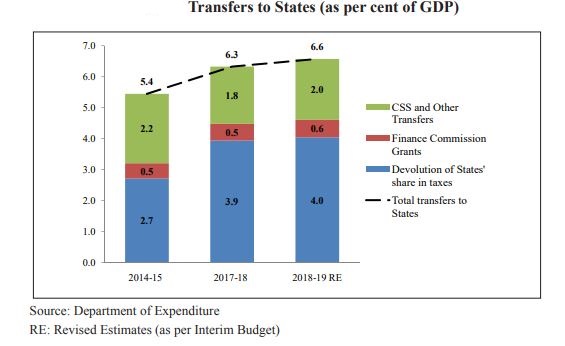

- Both in absolute terms and as a percentage of GDP, total transfers to States have risen between 2014-15 and 2018-19 RE.

- [Total transfers to States have risen by 1.2 percentage points of GDP over this period.]

- The General Government (Centre plus States) has been on the path of fiscal consolidation and fiscal discipline.

- Several challenges on the fiscal front in 2019-20 include -

- revenue implications on account of apprehensions of slowing of growth

- revenue buoyancy of GST

- provisioning for schemes such as PM-KISAN without compromising the fiscal deficit target

MONEY MANAGEMENT AND FINANCIAL INTERMEDIATION

- Monetary policy - Monetary policy witnessed a u-turn over the last year.

- This was because the benchmark policy rate was first hiked by 50 bps and later reduced by 75 bps.

- The factors responsible were weaker-than-anticipated inflation, growth slowdown and softer international monetary conditions.

- Liquidity - Liquidity conditions have remained systematically tight since September 2018, thereby affecting the yields on government papers.

- Banking system - The performance of the banking system has improved as NPA ratios declined and credit growth accelerated.

- However, financial flows to the economy remained constrained.

- This was due to the decline in the amount of equity finance raised from capital markets and stress in the NBFC sector.

- Capital mobilized through public equity issuance declined by 81% in 2018-19.

- Credit growth rate year-on-year of the NBFCs has declined from 30% in March 2018 to 9% in March 2019.

- Insolvency and bankruptcy ecosystem is improving with recovery and resolution of significant amount of distressed assets as well as improved business culture.

- Until March 31, 2019, the CIRP (Corporate Insolvency Resolution Process) yielded a resolution of 94 cases.

- Moreover, as on February 28, 2019, 6079 cases involving Rs. 2.84 lakh crores have been withdrawn before admission under provisions of IBC.

- Further, as per RBI reports, Rs.50,000 crore has been received by banks from previously non-performing accounts.

- Also, an additional Rs.50,000 crore has been "upgraded" from non-standard to standard assets.

- All these indicate a behavioural change for the wider lending ecosystem even before entering the IBC process.

PRICES AND INFLATION

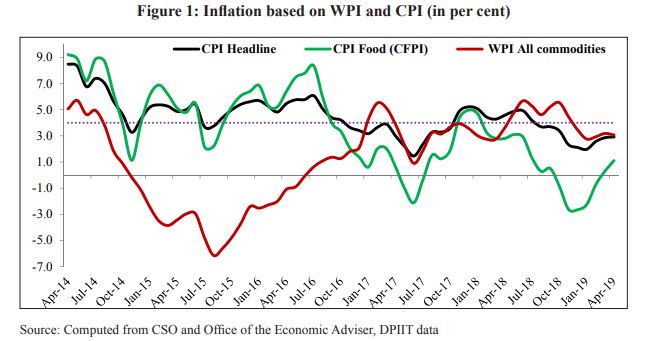

- Headline inflation based on CPI-C (CPI-Combined) continued its declining trend for fifth straight financial year.

- It has remained below 4% in the last 2 years.

- Food inflation based on Consumer Food Price Index (CFPI) too declined over the last 5 year.

- It has remained below 2% for the last two consecutive years.

- CPI-C based core inflation (CPI excluding the food and fuel group) increased during FY 2018-19 as compared to FY 2017-18.

- However, it has started declining since March 2019.

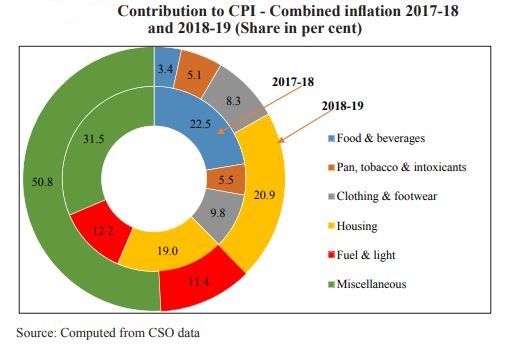

- Main contributors of headline inflation based on CPI-C during FY 2018-19 are miscellaneous, housing, and fuel and light groups.

- Relative importance of services in shaping up headline inflation has increased.

- CPI rural inflation declined during FY 2018-19 over FY 2017-18.

- CPI urban inflation, however, increased marginally during FY 2018-19.

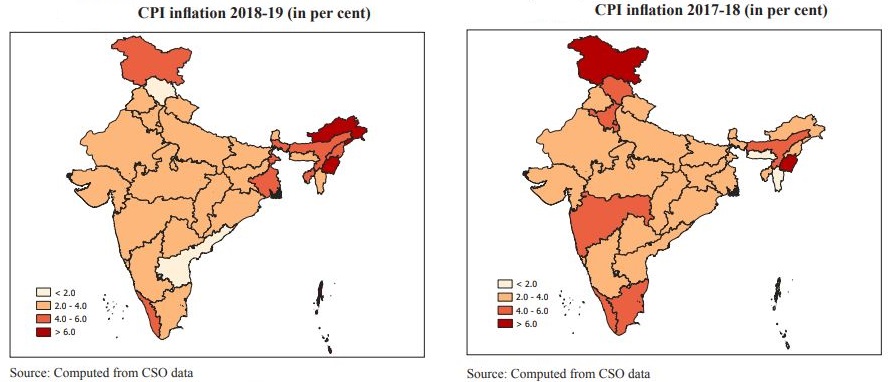

- Many States witnessed fall in CPI inflation during FY 2018-19.

- 16 States/UTs had inflation rate lower than All India average for FY 2018-19.

- Daman & Diu, having the lowest inflation, was followed by Himachal Pradesh and Andhra Pradesh.

SUSTAINABLE DEVELOPMENT AND CLIMATE CHANGE

- SDG targets - India follows a holistic approach towards its 2030 SDG (Sustainable Development Goals) targets by launching various schemes.

- India’s SDG Index Score ranges between 42 and 69 for States and between 57 and 68 for UTs.

- Kerala and Himachal Pradesh are the front-runners amongst all the states with a score of 69.

- Chandigarh and Puducherry are the front-runners among the UTs with a score of 68 and 65 respectively.

- Namami Gange Mission - The Survey mentions the mission as a key policy priority towards achieving the SDG 6 (clean water and sanitation for all).

- It was launched as a priority programme with a budget outlay of Rs. 20,000 crore for the period 2015-2020.

- A harmonized overarching national policy on Resource Efficiency, building upon the existing policies to address multiple sectors, should be devised.

- This is essential for mainstreaming Resource Efficiency approach in the development pathway for achieving SDGs.

- Air Pollution - On air pollution, the Survey takes note of the NCAP (National Clean Air Programme), launched in 2019, as a key initiative of the Government of India.

- The objective was to address the increasing air pollution across the country in a comprehensive manner.

- NCAP augmented the air quality monitoring network across the country.

- It also came as a pan India time bound national level strategy for prevention, control and abatement of air pollution.

- Climate change - India has continuously demonstrated its responsibility towards acknowledging the emerging threats from climate change.

- It was implementing climate actions on the basis of the principles of Equity and Common but Differentiated Responsibilities.

- India’s positive engagement at CoP 24 negotiations in Katowice, Poland in 2018 resulted in protection of key interests which include -

- recognition of different starting points for developed and developing countries

- flexibilities for developing countries

- consideration of principles including equity and Common but Differentiated Responsibilities and Respective Capabilities

- Climate finance - The Paris Agreement emphasizes the role of climate finance in strengthening the global response to climate change.

- The international community witnessed various claims by developed countries about climate finance flows.

- However, the actual amount of flows is far from these claims.

- It is to be noted that without sufficient climate finance, the proposed NDCs would not fructify.

- Implementing India’s NDCs requires investments of scale and size which is unprecedented.

- So, along with domestic public budgets, international public finance and private sector resources will have to be mobilized from a variety of sources.

Source: Ministry of Finance website

Part III will include contents on External sector, Agriculture and Food Management, Industry and Infrastructure, Services Sector, Social Infrastructure, Employment and Human Development