Why in news?

The latest set of economic data on the growth of the core sector industries was released recently.

What is the core sector index?

- The index of eight core industries comprises coal, crude oil, natural gas, steel, cement, electricity, fertilizer and refinery products.

- The index makes up 40.27% of the Index of Industrial Production (IIP).

- Given this, the recent data indicates the implications it could have on the industrial production data to be released.

What are the highlights?

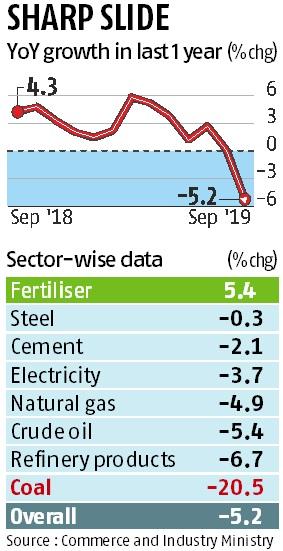

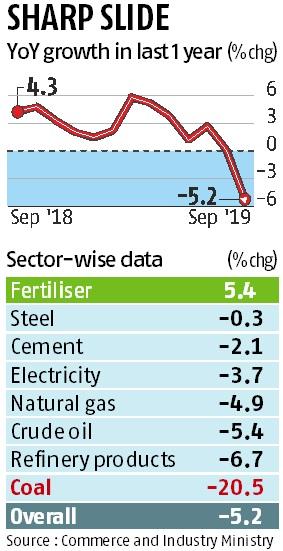

- The core sector growth for the month of September 2019 contracted massively by 5.2% from the 0.5% contraction seen in August 2019.

- This is its worst fall in 14 years.

- The cumulative growth during the period of April-September 2019-20 was 1.3%.

- The current index was dragged down by coal mining which came in at -20.5%.

- Coal sector growth is at -20.5% vs -8.6% month-on-month.

- Crude oil output growth for September is unchanged at -5.4% month-on-month.

- Natural gas output growth is down at -4.9% vs -3.9% month-on-month.

- Refinery products growth is at -6.7% vs 2.6% month-on-month, steel output growth at -0.3% vs 5% month-on-month and cement output growth is at -2.1% vs -4.9% month-on-month.

- Electricity output growth for the month of September stood at -3.7% vs -2.9% month-on-month.

- The fertilisers sector was the only outlier in the numbers, with 5.4% vs 2.9% month-on-month.

What do the figures imply?

- Contraction in core sector output indicates that the much-expected economic recovery is still far away.

- Seven out of the eight core industries witnessed a contraction, with the coal sector being the worst hit.

- Given that core sector contraction was only 0.5% in August, the trend points towards a worsening of the economic situation.

- The dull core sector performance will likely affect GDP growth in the second quarter as well as the full financial year.

- The core sector represents the capital base of the economy.

- So the contraction in this suggests that the negative effects of the fall in consumption are spreading across the entire production chain.

What are the further challenges?

- Data released by the Centre for Monitoring Indian Economy showed that unemployment rose to a 3-year high of 8.5% in October 2019.

- This marks a sharp jump from 7.2% in September 2019.

- If growth fails to pick up, the unemployment scenario could get worser and further contribute to the demand slowdown.

- More worryingly, the current slowdown comes in the midst of a spree of aggressive RBI rate cuts amounting to 135 basis points since February 2019.

- Lending in the festival season has picked up with banks extending over Rs. 1 lakh crore in the period between mid-September and mid-October 2019.

- Yet, growth in credit this financial year till now is a flat 0.2% only.

- Festival season sales have shown an uptick with increase in sales of automobiles and consumer durables.

- But, it remains to be seen if this trend would sustain.

What lies ahead?

- In the present scenario, there is very little fiscal leeway for the government at the Centre to boost growth by increasing its spending.

- Some of the reforms announced in the last few months may show some positive results with time.

- However, there is a crucial need for more meaningful structural reforms to address long-term problems such as the private sector’s reluctance to invest.

Source: Economic Times, The Hindu