Why in news?

The Central Board of Direct Taxes (CBDT) recently released the new time series data (same data points recorded at regular intervals) as updated up to FY 2017-18.

What are the highlights?

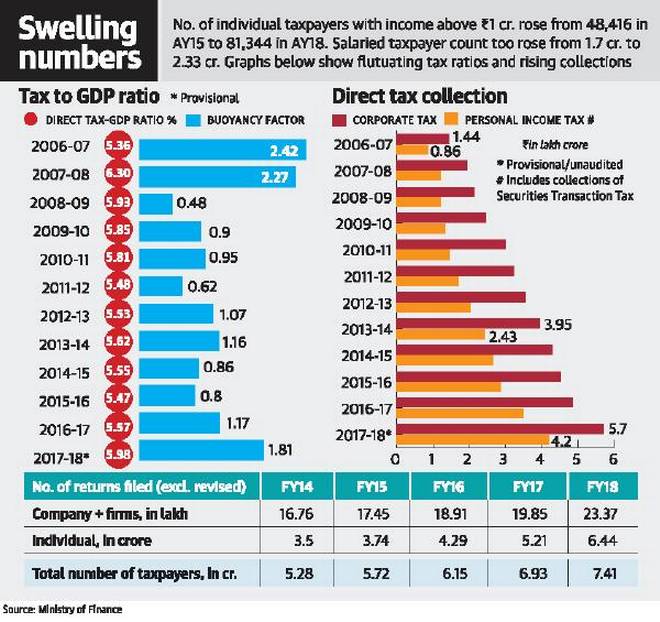

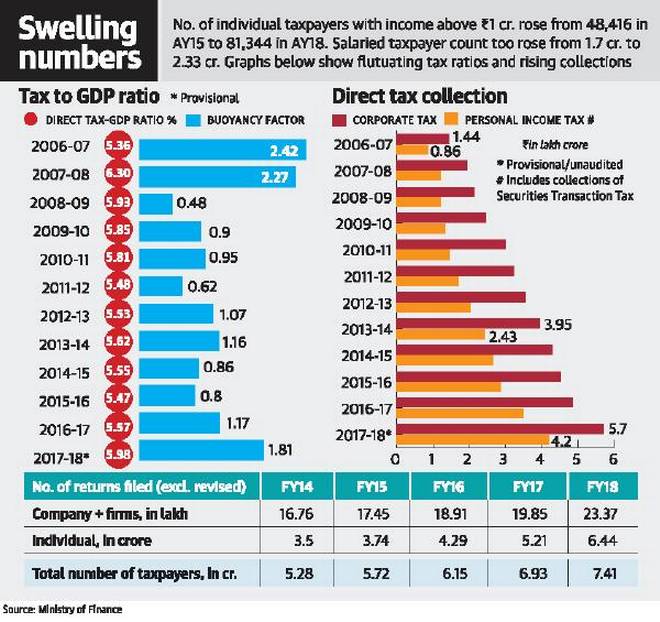

- Returns - The direct tax base has significantly widened in the last few years.

- There is a growth of more than 80% in the number of returns filed in the last four financial years.

- They rose from 3.79 crore in FY 2013-14 to 6.85 crore (these figures include revised returns) in FY 2017-18.

- Further, the number of persons filing income tax returns also increased by about 65% during this period.

- Income - The CBDT made public the income-distribution data for assessment year (AY) 2016-17 and AY 2017-18.

- There has been a continuous increase in the amount of income declared.

- This is true with all categories of taxpayers, over the last three assessment years.

- For AY 2014-15, corresponding to FY 2013-14 (base year), the return filers had declared gross total income of Rs. 26.92 lakh crore.

- This has increased by 67% to Rs. 44.88 lakh crore for AY 2017-18.

- This shows a higher level of compliance resulting from various legislative and administrative measures, including the enforcement measures against tax evasion.

- Taxpayers - The overall number of taxpayers declaring an income above Rs. 1 crore a year saw a sharp growth of about 60% over the 3 years under consideration.

- This included corporates, firms, and Hindu Undivided Families.

- Likewise, the number of individual taxpayers disclosing income above Rs. 1 crore saw a growth of 68% in this period.

- There is also an improvement in the compliance of salaried taxpayers.

- It rose from 1.70 crore for AY 2014-15 to 2.33 crore for AY 2017-18, an increase of 37%.

- The average income declared by these salaried taxpayers has also gone up by 19%.

- In the same period, there has been a growth of 19% in the number of non-salaried individual taxpayers.

- Also, the average non-salary income declared rose by 27% between AY 2014-15 and AY 2017-18.

- Tax-GDP ratio - The direct tax-GDP ratio rose to 5.98% in FY 2017-18, the highest it has been in the last 10 years.

What were the driving factors for widening tax base?

- Some of the reasons for increase in the number of tax returns include -

- the effect of demonetisation

- the increase in the use of information being collected digitally and being used by the tax department

- the movement towards digital assessment and decrease in the number of cases being picked up for scrutiny

- the ease of getting refund, majorly by small and medium taxpayers

- TDS - The system of tax deduction at source (TDS) is mandated by law on all those who make payments above a specified level in a year.

- It allows the tax department to mobilise income-tax and corporation tax without much hassle or additional cost.

- In 2014-15, the share of TDS in gross direct tax receipts was about 32% and had risen to 36% last year.

- Advance taxes - Advance tax is the payment of income tax in advance instead of lump sum payment at year end i.e. 'pay as you earn tax'.

- The combined share of these two instruments (TDS and advance tax) in total direct tax collections is almost 76%.

- Also, the cost of direct tax collections has come down from a high of 0.66% of total revenue garnered in 2016-17 to 0.61% in 2017-18.

What is the concern with direct taxes share?

- The contribution of direct taxes to the total amount of taxes collected rose every year through the first decade of this century.

- It increased from around 36% in 2000-01 to nearly 60% in 2009-10.

- But this was reversed in 2010-11, when the share fell to around 56%.

- Also, thereafter, despite spikes in some years, the broad trend has been that of decline.

- The share of direct taxes has fallen every single year since 2013-14, except this year.

- It is about 52% in 2017-18, but less than the 2009-2010 peak of 60%.

- So most of the rise in the total tax collection in the last few years has come from indirect tax collections.

What lies ahead?

- This year, direct tax collection increased at a higher rate compared to the collection of indirect taxes.

- A further increase in the direct taxes share will help lower regressive indirect taxes that impose a significant burden on the poor.

- Direct taxes are also a better choice from the standpoint of economic efficiency.

- It's because they help avoid the severe distortionary effects of indirect taxes such as the GST.

- Amidst increasing global tax competition, India is likely to face pressure to bring down corporate tax rates.

- This is inevitable if it wants to maintain its stature as an attractive investment destination.

- So the government has to address the issues in its efforts to draft a new direct tax code.

Source: The Hindu, Indian Express, Business Standard